Failing to plan your exit isn’t just an oversight—it can jeopardize the very value and legacy you’ve built. For Bengaluru’s business leaders, HNIs, and family patriarchs, an exit strategy is a process, not a one-time event. Ideally, it begins the day you open your doors—but “someday” often arrives sooner than expected.

The High Cost of “Someday” Planning

- Sub-Maximal Sale Price: Without the right preparation, buyers won’t pay full market value for your enterprise.

- Unprepared for Due Diligence: Surprises in your financials, contracts, or legal structure erode trust and leverage.

- Tax Inefficiencies: Poor timing or structure can balloon tax liability—diminishing your personal retirement funding.

- Emotional Regret: Years of hard work can end in frustration if you exit with less than you deserve or envisioned.

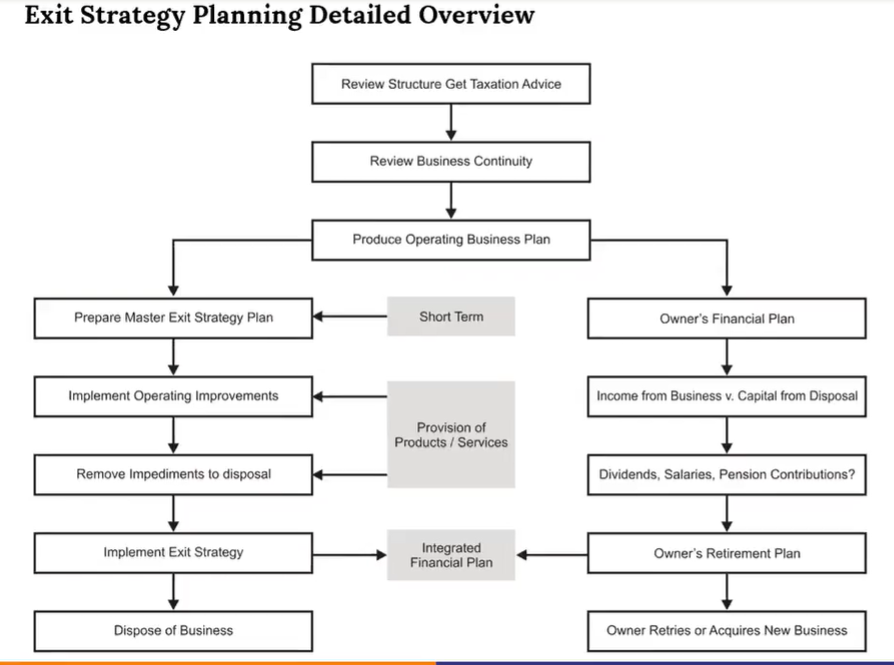

First: Business Exit Strategy Planning Overview

Exit Planning Steps

- Decide Your Time Frame

- Immediate liquidity? 3–5 years? 10+ years?

- Choose the Optimum Exit Option

- Sale to third party, management buyout, ESOP liquidity event, IPO, merger, wind-down.

- Structural & Tax Planning

- Entity restructuring, holding-company creation, valuation readiness, continuity carve-outs.

- Groom Successor or Management

- Leadership pipeline, mentorship, formal roles, external hires if needed.

- Remove Impediments

- Clean up litigation, normalize contracts, resolve shareholder disputes.

- Disposal Preparations

- Data room creation, audited financials, management presentations.

- Integrate Personal & Business Plans

- Align your retirement cash-flow needs with projected sale proceeds and tax timing.

- Execute the Disposal

- Negotiation, SPA signing, closing, hand-over and escrow arrangements.

Detailed Exit Strategy Overview

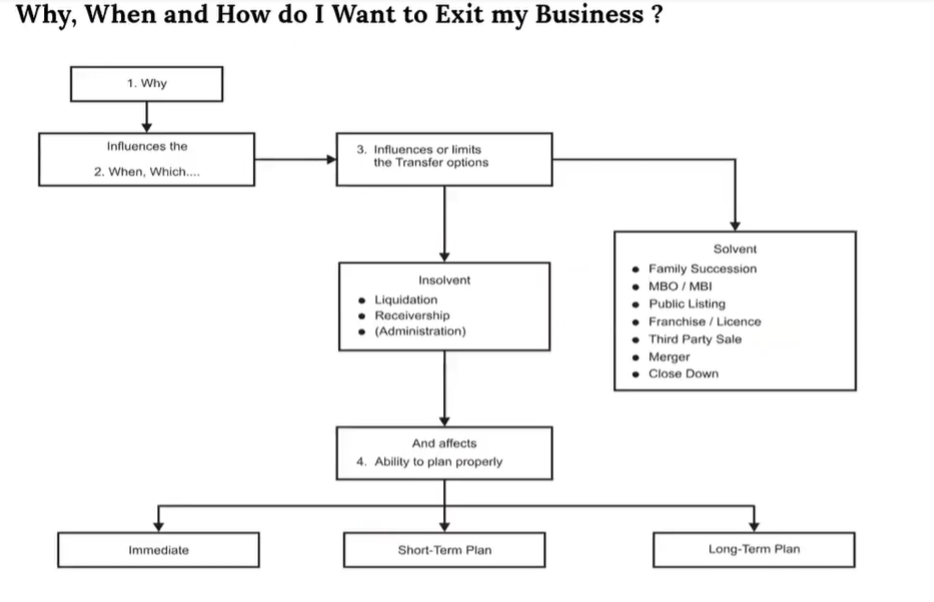

Why, When & How Do I Want to Exit?

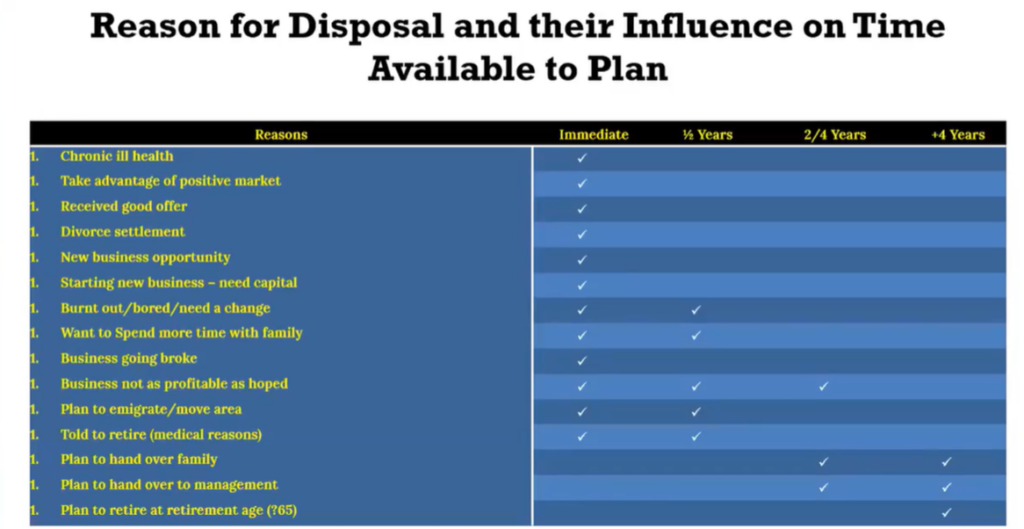

Reasons for Disposal & Time Available to Plan

Key Questions to Ask

- Market Conditions: What multiples are buyers paying today in your sector?

- Economic & Industry Trends: Is your industry consolidating or fragmenting?

- Tax Implications: What tax rates apply now vs. if you wait 2–5 years?

- Operational Readiness: Are there legacy issues (leases, licensing, debt) depressing value?

- Shareholder Alignment: Do fellow shareholders support the timing and method of exit?

- Key Management Retention: Will your leadership team stay on post-deal?

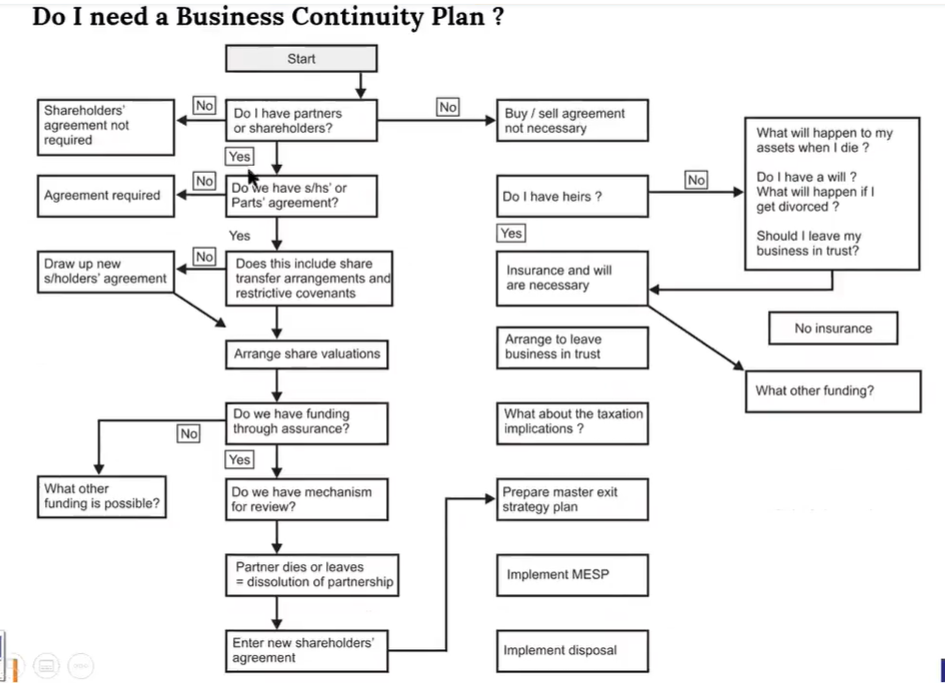

Second: Business Continuity Planning

Even if you’re exiting, the continuity of value—during sale or transition—matters hugely. Two foundational decisions:

- Corporate Structure for Exit Effectiveness

- Should you reorganize into a holding-company structure, separate operating and real-estate assets, or spin off divisions?

- Formal Agreements for Smooth Separation

- Shareholders’ agreements, employment covenants, IP assignment deals, and non-compete clauses.

Entity Structuring Matters

Choosing the right entity is as critical as choosing your successor. Structure affects:

- Tax Efficiency: Pass-through vs. corporate taxation of sale proceeds.

- Liability Shielding: Protects personal and family assets from creditor claims.

- Transfer Simplicity: Facilitates share transfers or asset sales without complex regulatory hurdles.

Common Entity Types in India

- Sole Proprietorship

- General Partnership

- Limited Liability Partnership (LLP)

- Private Limited Company

- Public Limited Company

Tip: For a seamless exit to heirs or third parties, a pass-through entity (LLP or Private Ltd) often minimizes tax drag and regulatory burdens.

Do You Need a Business Continuity Plan?

If you plan to exit, sell, or transition at any point, a continuity plan is non-negotiable. It ensures:

- Operational Resilience: Key customers, contracts, and processes remain intact.

- Leadership Preparedness: Successors can execute without a steep learning curve.

- Value Preservation: Prevents value leakage between “decision to sell” and “deal close.”

Final Thoughts

A robust exit strategy isn’t a luxury—it’s the capstone of decades of hard work. Start today: align your exit timeline, entity structure, management development, and personal financial goals into a cohesive plan.

Ready to secure your legacy?

Call/WhatsApp: +91 97436 83444

Email: sandeep@sandeepnsetty

Meet for Tea/Coffee in Bengaluru to craft your bespoke exit and continuity roadmap.