Life is unpredictable. No one wants to think about the worst happening, but planning ahead can make a big difference. That’s where term insurance comes in. It’s one of the simplest and most affordable ways to ensure your family is financially protected if you are no longer around. In this article, we’ll break down what term insurance is, how it works, and why it might be your smartest financial decision.

What Is Term Insurance?

Term insurance is a type of life insurance that covers you for a specific period, say 10, 20, or 30 years or more. If something happens to you during this term, the insurer pays a fixed amount, known as the death benefit, to your chosen beneficiaries. This money helps your family handle daily living costs, loans, education fees, medical bills, etc.

Unlike other life insurance plans, term insurance doesn’t include any investment or savings component. It’s a “pure protection” plan, so it’s affordable. You pay only for the insurance, not for any extras.

Why Term Insurance Makes Sense

Here are some practical reasons why term insurance is a wise financial decision:

Cost-Effective: Term Life Insurance offers a budget-friendly solution for those juggling other pressing financial obligations.

Enhanced Flexibility: A wide variety of Term Life options and combinations are available to precisely match your unique needs.

Ideal for Short-Term Coverage: Term Life Insurance is well-suited for covering time-specific obligations such as mortgages, business loans, personal debts, or your children’s education. Its coverage period is tailored to secure liabilities and commitments with a defined duration, ensuring your financial responsibilities are well-protected.

Key Features of Term Insurance

Large Sum Assured – Term insurance allows you to choose a high sum assured (like ₹5 crore or more) without paying high premiums. This makes it accessible for young professionals or middle-income families.

Flexible Payout Options – Your family can receive the benefit either as a lump sum or in monthly/annual installments. This helps manage their needs better over time.

Return of Premium Option (ROP) – Some term plans offer a “Return of Premium” feature. If you survive the policy term, all the premiums you paid are returned. It’s a way to get protection plus peace of mind that your money won’t be “lost.”

Riders for Extra Protection – You can enhance your term plan by adding riders like:

1. Critical illness rider

2. Accidental death benefit

3. Waiver of premium in case of disability

These riders provide additional coverage during life-threatening or financially disruptive events.

Tax Benefits – You can save up to ₹54,600 in taxes through deductions under Section 80C and 80D of the Income Tax Act.

Premium Waiver – In case of permanent disability due to an accident, future premiums are waived but your coverage continues.

Increasing Cover Option – To fight inflation, some plans let you increase your sum assured over time. For example, you might increase your cover by 50% when you get married or by 25% when you become a parent.

Who Should Buy Term Insurance?

Term insurance is not just for people with large incomes. It’s for anyone with financial responsibilities. Here’s who can benefit:

1. Young Professionals: Lock in low premiums while you’re young and healthy.

2. Newly Married Couples: Secure your spouse’s future.

3. Parents: Ensure your kids’ education and upbringing are not affected if you’re not around.

4. Homeowners: Protect your family from losing their home due to unpaid loans.

5. Self-Employed Individuals: Without employer-provided benefits, term insurance offers a safety net.

6. NRIs: Secure your family in India even if you live abroad.

7. Housewives: Their absence can lead to real financial costs. A term policy helps cover them.

Types of Term Insurance

India offers a variety of term insurance plans. Here’s a quick overview:

1. Level Term Insurance – Same coverage and premium throughout the term.

2. Increasing Term Insurance – Coverage increases annually to keep up with inflation.

3. Decreasing Term Insurance – Coverage decreases over time, ideal for repaying loans.

4. Term Insurance with Return of Premium (TROP) – Premiums are returned if you survive the term..

How Does Term Insurance Work?

1. You choose a coverage amount (like ₹5 crore) and term (e.g., 30 years).

2. The premium is calculated based on your age, health, and habits (like smoking).

3. You pay monthly, quarterly, or annually.

4. If you pass away during the term, your nominee gets the full sum assured.

5. If you outlive the policy and didn’t choose ROP, there is no payout – but your family stayed protected during that time.

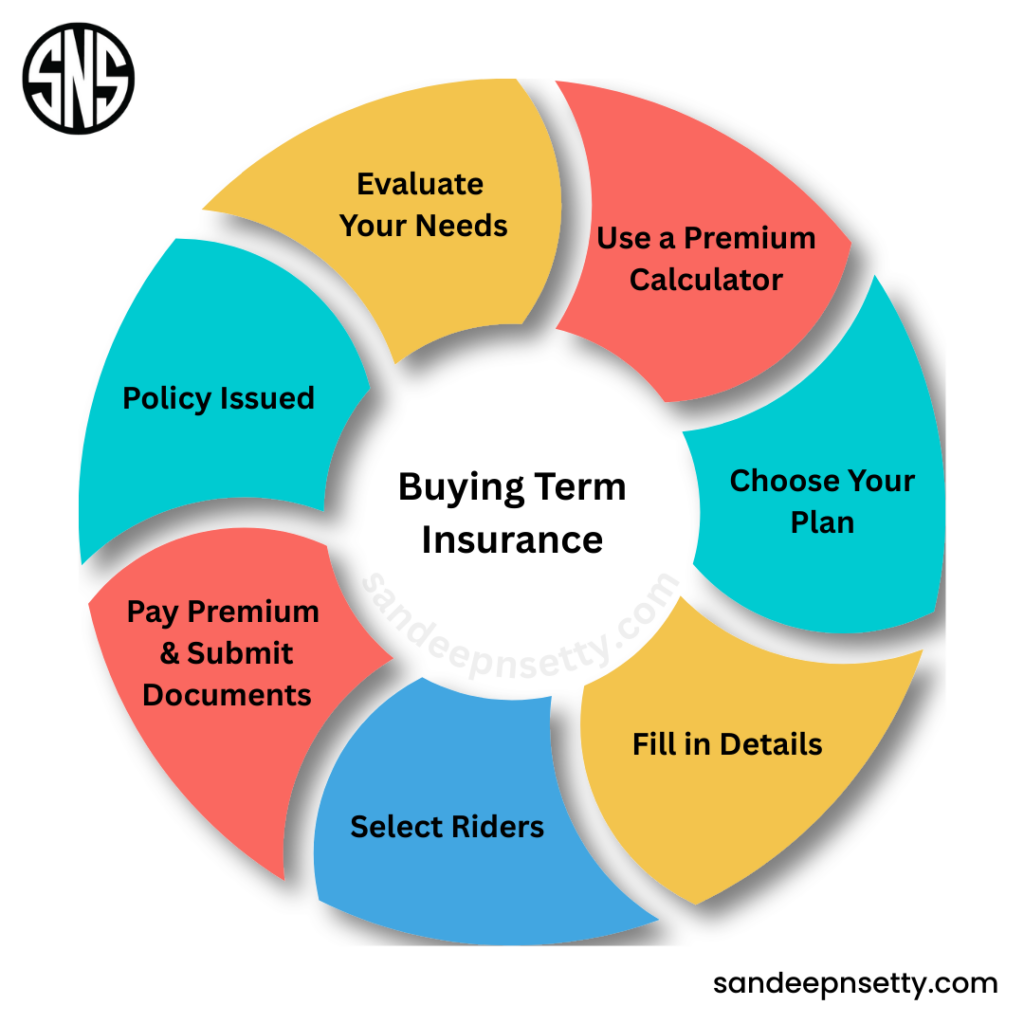

Buying Term Insurance

It is highly recommended that you speak to a financial advisor before buying term insurance; the advisor can help you better understand the terms and conditions and the economic trends and challenges.

1. Evaluate Your Needs: Consider your loans, family expenses, and future goals.

2. Use a Premium Calculator: Estimate how much you’ll need to pay based on your age, income, and cover.

3. Choose Your Plan: Compare plans from trusted insurers like HDFC Life, SBI, LIC, etc.

4. Fill in Details: Share basic information like age, gender, and income.

5. Select Riders: Add extras like critical illness cover if needed.

6. Pay Premium & Upload Documents: Make payment and submit KYC documents.

7. Policy Issued: Once approved, you’ll receive your policy digitally.

Why Start Now?

Delaying life insurance could mean higher premiums or loss of insurability if your health changes. Starting early locks in low premiums and ensures long-term protection.

Final Thoughts

Term insurance is a no-nonsense, cost-effective tool to protect your loved ones. Whether you’re just starting your career or building a family, a term insurance plan fits your needs. It’s not just about money, it’s about making sure your family can live with dignity, even in your absence.