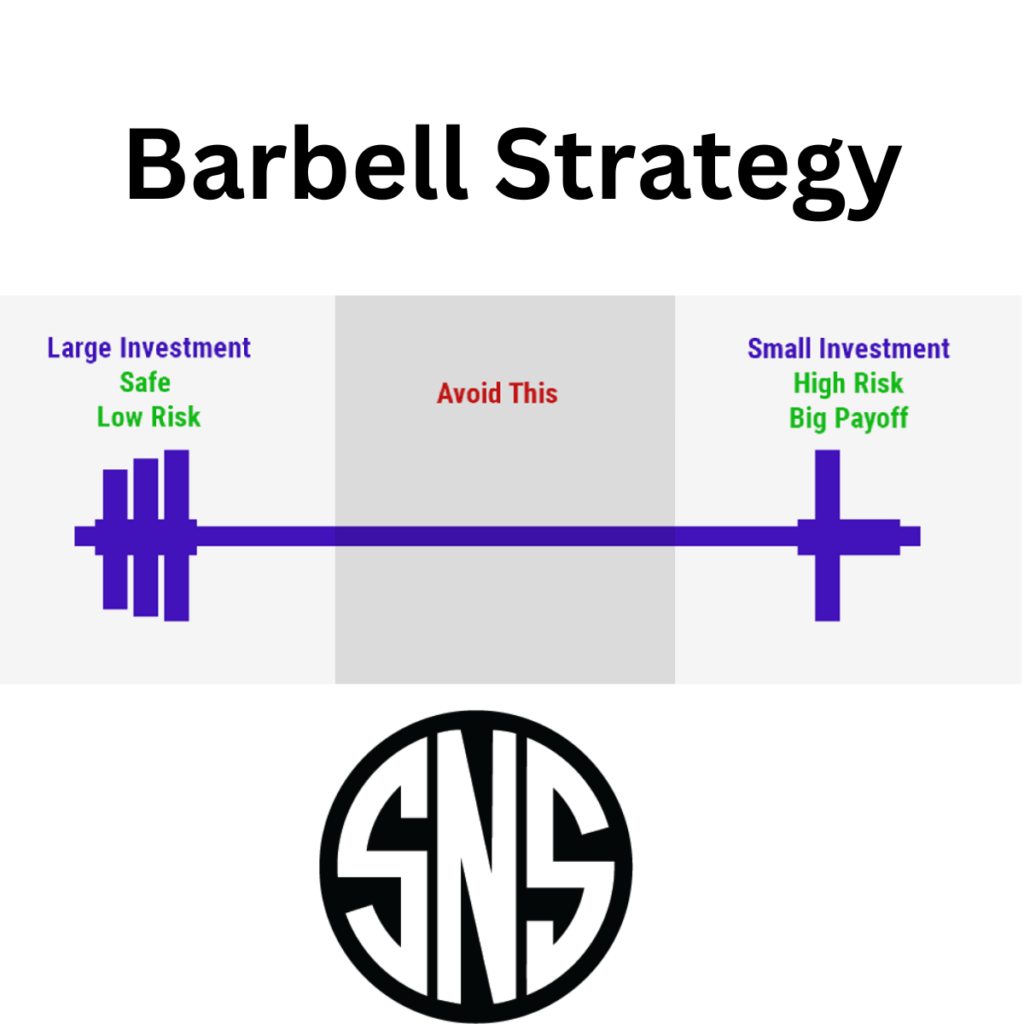

In the world of wealth management, one strategy that stands out for high-net-worth families and successful business owners is the barbell strategy. This approach may sound complex, but at its core, it’s all about balancing risk and reward by dividing your investments between two extremes.

What Is the Barbell Strategy?

The barbell strategy involves concentrating your portfolio at two ends:

- Low-Risk Assets: These are your safe-haven investments that provide stability and liquidity. Think high-quality bonds, cash reserves, or other assets that preserve capital.

- High-Risk, High-Reward Assets: On the other end, you allocate a portion of your portfolio to more aggressive investments. These might include growth stocks, venture capital, or other opportunities with significant upside potential.

By focusing on both ends of the risk spectrum, you protect your portfolio from downside risk while still capturing opportunities for substantial gains.

Why It Suits High-Net-Worth Families and Business Owners

For those managing significant wealth, the barbell strategy offers several key advantages:

- Risk Mitigation: By holding a substantial allocation in low-risk assets, you safeguard your wealth against market volatility and economic downturns. This is critical for preserving your family’s financial legacy.

- Opportunity for Growth: The portion invested in high-risk assets allows you to benefit from market opportunities that can deliver outsized returns. This means your wealth continues to grow even in competitive environments.

- Flexibility and Liquidity: Maintaining a healthy cash reserve or other liquid investments provides you with the ability to seize new opportunities quickly. Whether it’s an emerging market trend or a strategic business investment, you’re well-positioned to act.

- Tailored to Long-Term Goals: The barbell strategy is inherently adaptable. It supports long-term wealth preservation and intergenerational planning, ensuring that your legacy remains robust, regardless of market fluctuations.

Implementing the Barbell Strategy

To effectively implement this strategy, consider these steps:

- Assess Your Risk Tolerance: Understand your current financial situation and your ability to absorb market shocks without jeopardizing your long-term goals.

- Define Your Allocation: Determine what proportion of your portfolio should be allocated to low-risk versus high-risk assets. This balance will depend on your personal and family’s financial objectives.

- Regular Review and Rebalancing: The market is dynamic, and so should be your portfolio. Regular reviews and rebalancing ensure that your investment mix remains aligned with your risk tolerance and growth targets.

- Leverage Expert Guidance: High-net-worth families and business owners often benefit from professional financial advice. A trusted advisor can help tailor the barbell strategy to your specific needs and guide you through market complexities.

A Balanced Path Forward

The beauty of the barbell strategy lies in its simplicity and effectiveness. It’s not about chasing every opportunity or trying to predict market highs and lows; it’s about creating a robust framework that allows you to thrive in both stable and turbulent times. By protecting your capital with low-risk assets while also investing in high-growth opportunities, you’re setting up a balanced approach to wealth management that can serve you and your family for generations.

In an ever-changing financial landscape, strategies like the barbell approach remind us that sometimes the most powerful solutions are those that balance caution with ambition. How are you balancing risk and reward in your wealth planning?