Quick Quiz: Pause, Reflect, And Answer Honestly.

1. Do you want full control over your property while you’re alive?

Answer: Absolutely.

Yet 65% of Indian families report losing control of assets due to outdated documents or informal agreements.¹ When you procrastinate, you hand the reins to chance—professional fees, unexpected disputes, even court orders.

2. Do you want to care for your loved ones if you become disabled?

Answer: At minimum, yes.

Case study: Mr. Gupta, 58, set up a durable Power of Attorney—and when he suffered a stroke, his family accessed ₹50 lakhs within days to cover medical bills, avoiding weeks of red tape.

Without this simple step, families can wait up to 6 months for asset access.²

3. Do you want to give “what you want, to whom you want, how you want, when you want”—after you’re gone?

Answer: Unquestionably.

Your wealth is your life’s masterpiece. Do you want to:

- Gift your Bengaluru home to your daughter?

- Reserve ₹10 lakhs for your grandchild’s education?

- Endow a charity close to your heart?

Estate planning (wills, trusts, wealth‑transfer strategies) ensures your instructions are followed exactly—avoiding family feuds and probate delays.

4. Do you want to minimize costs on fees, transfer duties, and courts?

Answer: Of course.

Indian probate courts can charge up to 5% of estate value, plus legal fees.³ Pre‑planning via trusts or gift deeds can save ₹20 lakhs or more—money that stays in your family, not with lawyers.

The Simple Answer: You Need Estate Planning

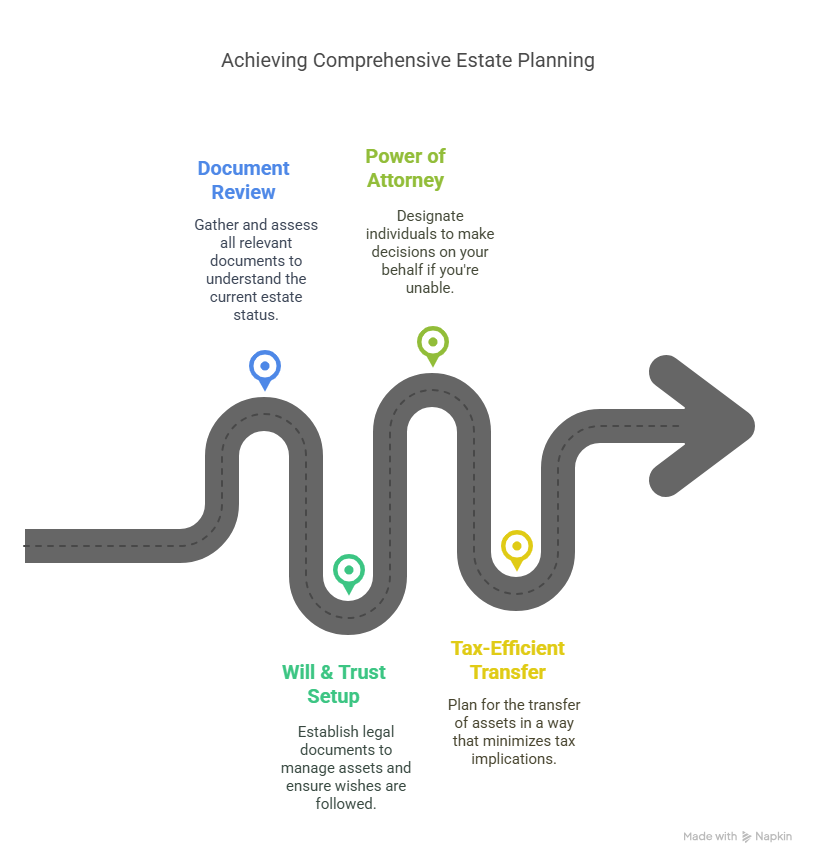

Estate planning is more than “writing a will.” It’s a comprehensive strategy—combining wills, trusts, power of attorney, medical directives, and tax‑efficient transfers—to:

- Maintain control over your assets

- Protect yourself and dependents in incapacity

- Dictate precise distributions on death

- Slash professional and court costs

Why Now?

- 70% of estate disputes in India arise from unclear instructions.⁴

- Probate delays average 9 months—your heirs need immediate clarity.

- Every day you wait is ₹X in avoidable costs, disputes, and stress.

Ready to Sleep Peacefully at Night?

A 30‑minute, no‑obligation consultation could be your first step. Over a cup of tea or coffee, we’ll:

- Audit your current estate documents

- Identify gaps and tax‑saving opportunities

- Map out a bespoke wealth‑transfer plan

📅 Book your slot now

Estate planning isn’t an expense—it’s an investment in your peace of mind and your family’s future. Don’t leave it to chance. Let’s get it done right.