For parents and guardians in India, safeguarding a child’s inheritance goes beyond merely naming them as an insurance nominee. A Minor Beneficiary Trust—often called a Child Education or Minor’s Trust—is a legally enforceable way to manage and protect assets for minors until they reach specified milestones.

Why a Trust Beats Nomination Alone

- Nominee Limitations: Insurers typically pay nominees within 7–14 days, but the funds become the nominee’s absolute property—no legal controls curb misuse.

- Court Delays: Without a trust, court-appointed guardianship can take 3–6 months and cost ₹50,000–₹2 lakhs in fees.

- Spendthrift Protection: Trusts block creditors and prevent premature sale or pledge of assets.

SEO Keywords: “minor beneficiary trust India,” “child education trust,” “trust deed for minors.”

Quantified Impact

- Payout Speed: Trust receives proceeds in 7–10 days (per IRDAI guidelines) vs. 180+ days for guardianship release.

- Cost Savings: Avoids up to 20% of the fund value in court fees and legal charges.

- Example Policy Size: A ₹1.5 crore term policy funds higher education costs of ₹35 lakhs (overseas) plus living expenses.

Building Your Minor Beneficiary Trust: Five Steps

- Define Objectives & Ages:

- Education (domestic/overseas), healthcare, living expenses.

- Stagger distributions (e.g., 30% at age 18, 30% at age 21, 40% at age 25).

- Draft the Trust Deed:

- Appoint independent trustees (CA, lawyer, family office).

- Include spendthrift, disability, and fallback clauses for unused funds.

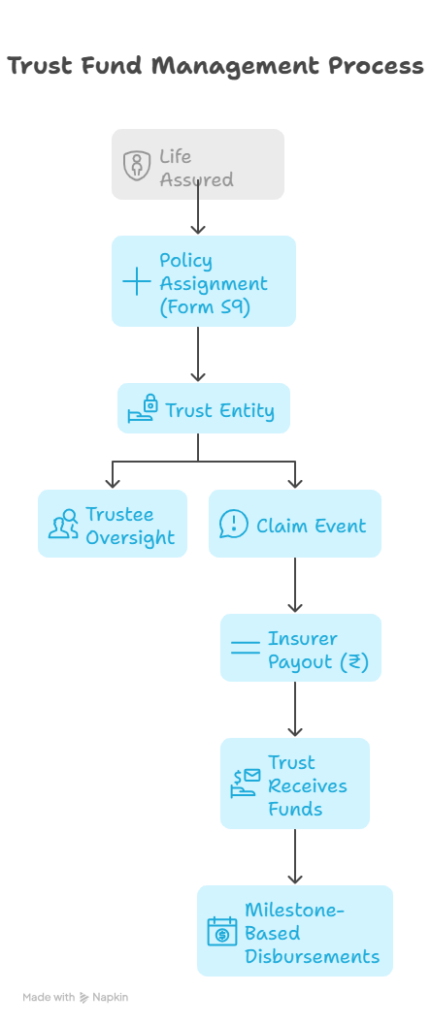

- Assign the Insurance Policy:

- Complete Form S9 to transfer ownership and beneficiary status to the trust per IRDAI norms.

- Notify insurer and verify trust registration.

- Consider Stamp Duty & Registration:

- Trust deeds attract state stamp duties (₹5,000–₹50,000) and required registration under the Indian Registration Act.

- Review Regularly:

- Update trust deed after marriages, births, or regulatory changes every 2–3 years.

Real-Life Example: The Sharma Family

- Policy: ₹1 crore term insurance assigned to a Minor Beneficiary Trust.

- Milestones: 30% at 18 for UG, 30% at 21 for PG, 40% at 25 for startup or marriage.

- Outcome: Trust received the payout in 8 days, funded ₹20 lakhs in school fees, and disbursed remaining amounts per milestones—shielding funds from daughter’s creditors and ensuring proper use.

Key Takeaways for Indian Families

- Control & Clarity: Trust deeds guarantee funds serve intended purposes.

- Legal Certainty: Bypass probate and guardianship courts by routing proceeds through a trust.

- Cost Efficiency: Save up to 20% in legal costs and avoid delays.

- Flexibility: Customize distributions, add special needs provisions, and allocate to charity.

Next Steps: Secure Your Child’s Future Today

Protect your minor beneficiary with a robust trust and insurance combination.

M: +91 9743683444 | E: sandeep@sandeepnsetty

Schedule a consultation to draft your Minor Beneficiary Trust and align it with your estate goals.