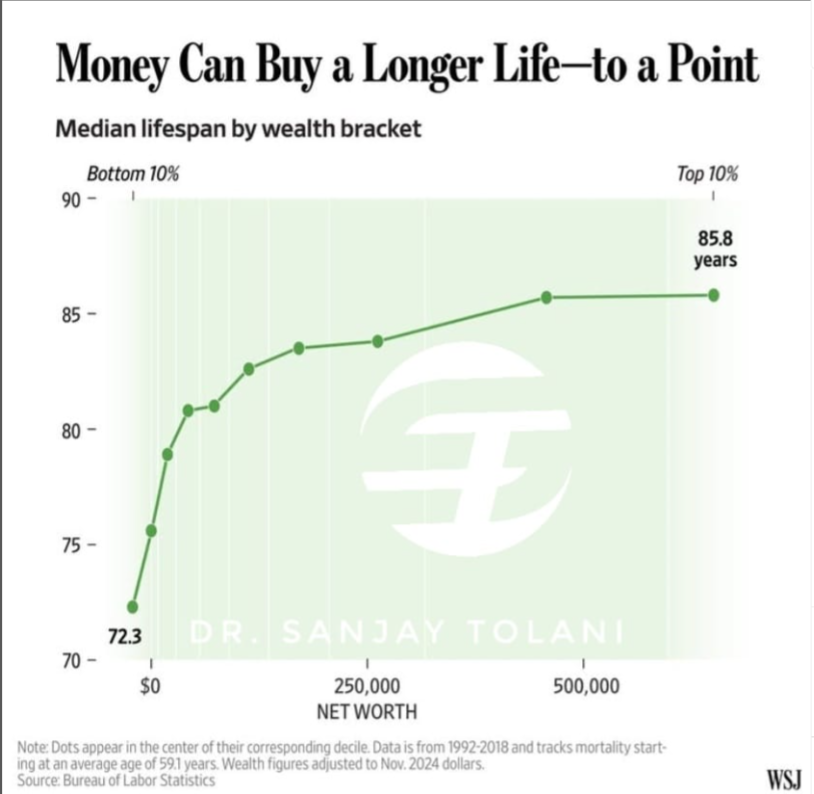

It might sound harsh, but here’s an uncomfortable truth: money buys time. Studies show that if you’re among the top 10% of the wealth bracket, you’re likely to live nearly 14 years longer than someone in the bottom 10%. And it’s not just about enjoying luxury—it’s about survival.

- Superior Healthcare Access: The wealthy benefit from the latest in healthcare technology, from routine annual check-ups to advanced surgeries. They have access to organic diets, personal trainers, and environments that support stress-free living.

- Lifestyle Differences: While the affluent can afford the best in preventative care, the less fortunate often juggle multiple jobs, miss out on essential health check-ups, and live in conditions that can harm their well-being.

- The Reality of Wealth and Longevity: As net worth increases, so does life expectancy—up to a point. Financial security enables people to afford not only better healthcare but also the time and resources to recover and maintain a healthy lifestyle.

Money plays a critical role in how long and how well we live. Without financial resources, chronic illnesses go untreated, stress becomes overwhelming, and life’s inherent challenges can shorten one’s lifespan.

But here’s an important twist: it’s not solely about being rich—it’s about being prepared. Whether you’re wealthy or not, having proper life insurance, comprehensive health coverage, and a solid financial plan can significantly boost your chances for a healthier and longer future.

The real question isn’t whether money can buy life—it’s whether you’re using it wisely to protect the years ahead.