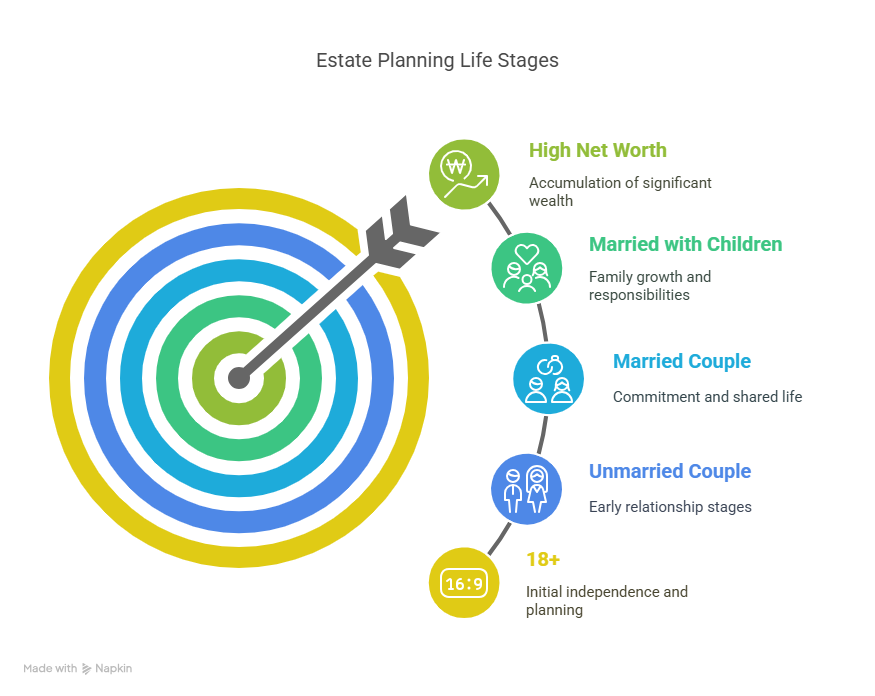

Estate planning isn’t a one‑time task—it evolves as your life does. From the moment you turn 18 through the peak of your wealth-building years, having the right documents, strategies, and conversations in place ensures your wishes are honored and your loved ones protected. Let’s walk through the key milestones and must‑haves at every stage of life.

1. Age 18+ (Unmarried)

At 18, you’re legally an adult—but you’re also vulnerable to unexpected events. Here’s what every single adult should have:

- Durable Power of Attorney

Incapacity can strike at any time. A Power of Attorney (POA) appoints someone you trust to manage your finances and make decisions if you become unable to act. - Nominations & Joint Accounts

Many banks and investment platforms let you nominate a beneficiary and add a parent (or another trusted person) as a joint account holder, ensuring quick access if you’re incapacitated. - Simple Will

Even if your assets are modest, a will ensures that any bank balances, personal items, or digital assets pass to the people you choose, not the state.

2. Unmarried but Committed

Living together without legal marriage has its benefits—but inheritance isn’t automatic:

- Create a Will

Without a will, your partner won’t inherit by default. A clear will spells out exactly what you want to leave to your significant other. - Joint Ownership with Right of Survivorship

If you purchase a property together, consider holding it jointly with right of survivorship. On your death, ownership automatically transfers to your partner outside probate.

3. Married Couple (No Children)

Marriage brings new layers of protection and planning:

- Mirror Wills

Mirror wills are two wills—one for each spouse—that are almost identical, naming one another as primary beneficiaries. - Spousal Joint Accounts

Add your spouse as a second holder on investment and bank accounts for seamless access during incapacity or after death. - Durable, Springing Power of Attorney

A springing POA “springs” into effect only if you’re declared incapacitated, giving your spouse authority when you need it. - Wealth‑Management Training

Teach your spouse how to manage accounts, pay bills, and oversee investments—so they’re not left scrambling during critical moments.

4. Married with Children

When minor children enter the picture, guardianship and trusts become crucial:

- Letter of Guardianship

Appoint a trusted guardian for your children in case both parents pass away simultaneously. Without it, the court decides for you. - Minor Beneficiary Trust

Set up a trust to hold and distribute assets to your children at ages or milestones you choose, protecting the funds until they’re ready. - Term Life Insurance Funding

A term life policy can fund the minor’s trust, providing liquidity for educational expenses and living costs without depleting other assets.

5. Significant Wealth Accumulated

As your estate grows, planning complexity increases:

- Document Review & Updates

Regularly revisit and update wills, POAs, and trusts to reflect new assets, changing family situations, or evolving tax laws. - Living (Revocable) Trust

Transfer assets into a trust you control while alive. On incapacity or death, the successor trustee steps in seamlessly—avoiding probate. - Trustee Selection & Communication

Name a responsible, financially savvy trustee (or corporate trustee). Discuss your intentions and give them a copy of key documents. - Family Meeting

Open dialogue with heirs about your wishes can prevent misunderstandings and conflicts down the road. - Centralized Doc Storage

Ensure your family knows where to find critical estate documents—wills, trust agreements, insurance policies, and POAs.

Taking Action Today

No matter where you are on your journey, a tailored estate plan gives you peace of mind, protects your loved ones, and preserves your legacy. Ready to map out your lifetime plan?

Let’s meet for tea/coffee and get started.